Sign up to receive our monthly portfolio reports here.

A series of High-Conviction Funds based on Behavioural Finance

Over the past 30 years Behavioural Finance has emerged as a serious alternative to the Efficient Market Hypothesis. Whereas the Efficient Market Hypothesis starts with the assumption that people (investors) are rational and profit-maximizing, Behavioural Finance builds upon empirical observations of how people actually behave, and goes on to explain securities prices from this principle. Along the development of Behavioural Finance, it has been able to explain many peculiarities that had remained puzzles under the Efficient Market Hypothesis.

Rosevalley Funds portfolios are built around the theoretical and empirical underpinnings of Behavioural Finance, and at heart take advantage of the way human beings behave in the real world.

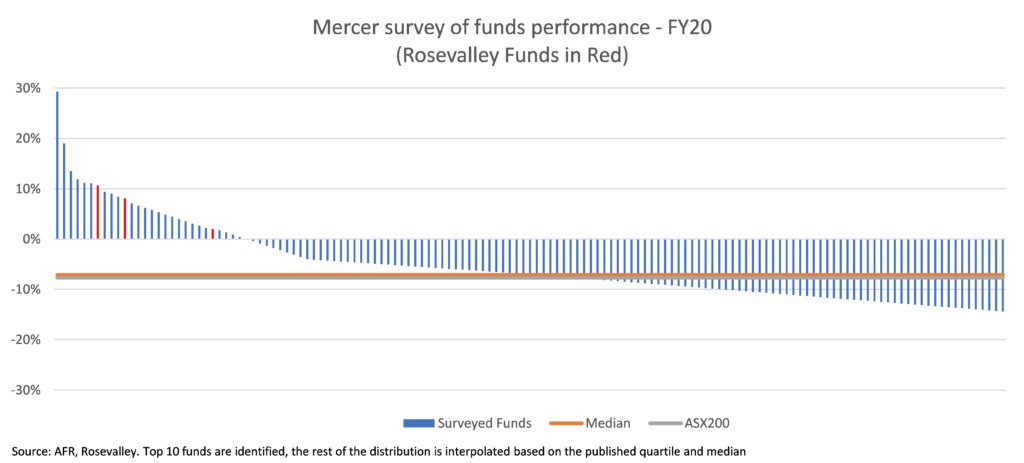

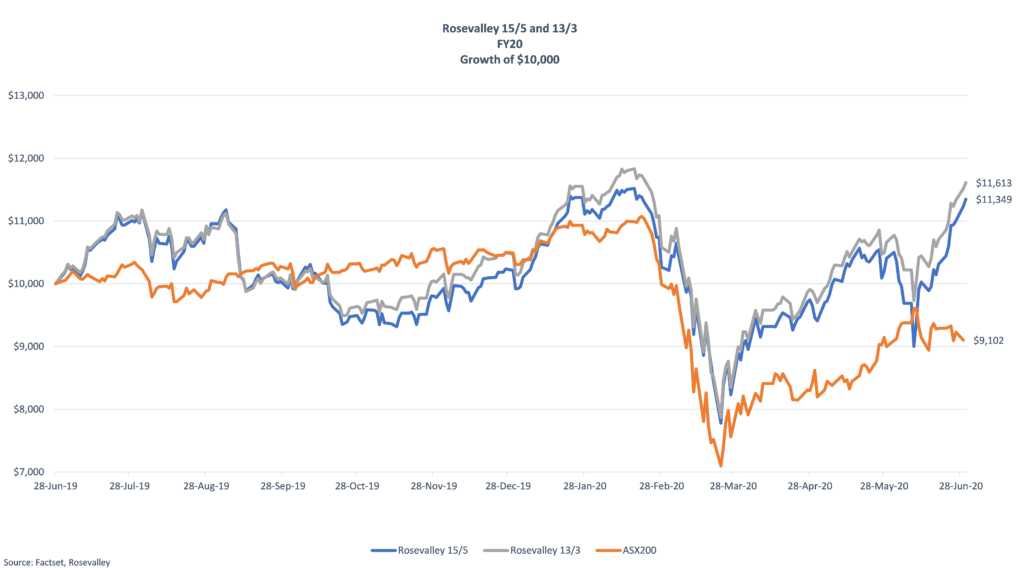

During the first two years of trading, performance was consistently in the top-10 best-performing large-cap equity funds in Australia, as published by the periodic Mercer surveys.

For more information contact us at info@rosevalleyfunds.com, or sign up to receive our monthly portfolio reports here.